Using Koinly To Complete Your Australian Tax Return

So you have been using a platform like CoinSpot to trade crypto during the financial year and now you have come time to prepare your tax return either through MyGov’s MyTax (the new form of ETax) or by sending your information to your accountant.

You are probably wondering what to report to the ATO if you are preparing your tax return yourself or if you have sent your crypto trades to your accountant they have probably sent you something back that they want you to pay thousands of dollars to prepare your tax return due to all the hours needed to calculate your crypto gains/losses. There is however an easier way!!! Introducing Koinly.

What Is Koinly?

Koinly is a platform that you upload your transactions to and it calculates things like your capital gain or loss, total sales of crypto, total purchases of crypto etc. All the amounts required for you to prepare your Australian income tax return.

How Do You Use Koinly?

First you need to join Koinly. It’s free to join and only takes a few seconds. From there you need to upload your information then purchase a tax report, which cost is determined by how many transactions you have uploaded.

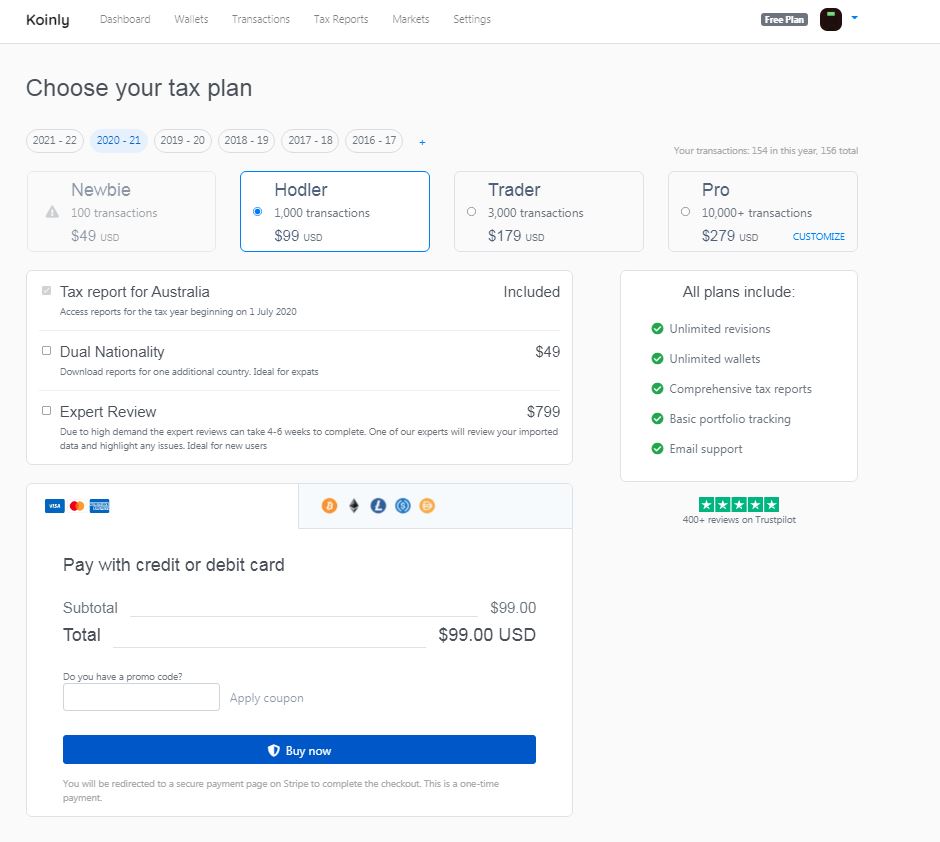

How Much Does Koinly Cost?

There are a few different options which you can see by going to settings in the top tab and then to plans. There is a newbie plan of 100 transactions for $49 USD, 3,000 transactions for $179 USD or a 10,000+ transactions for $279 USD. These are one time costs based on the number of transactions and not a monthly fee or annual subscription or anything. Just purchase what you require.

Why Should You Use Koinly?

It saves you time and money. If you prepare your taxes yourself you can generate the report of the information you require and do your tax return yourself. If you go to an accountant you can just provide them with your Koinly tax report and it will save you hundreds or even thousands of dollars in fees from your accountant. Your accountant will just use the reports to complete the necessary sections of your return in a few minutes.

Let’s Get Started With How To Use Koinly

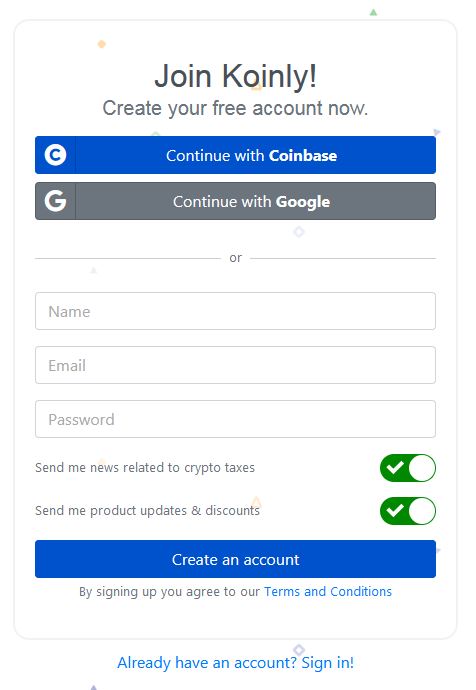

First thing you need to do is sign up. You can do this by continuing with Coinbase, using your Google account or by using your email. You can un-tick the “send me” boxes should you want no communication from Koinly.

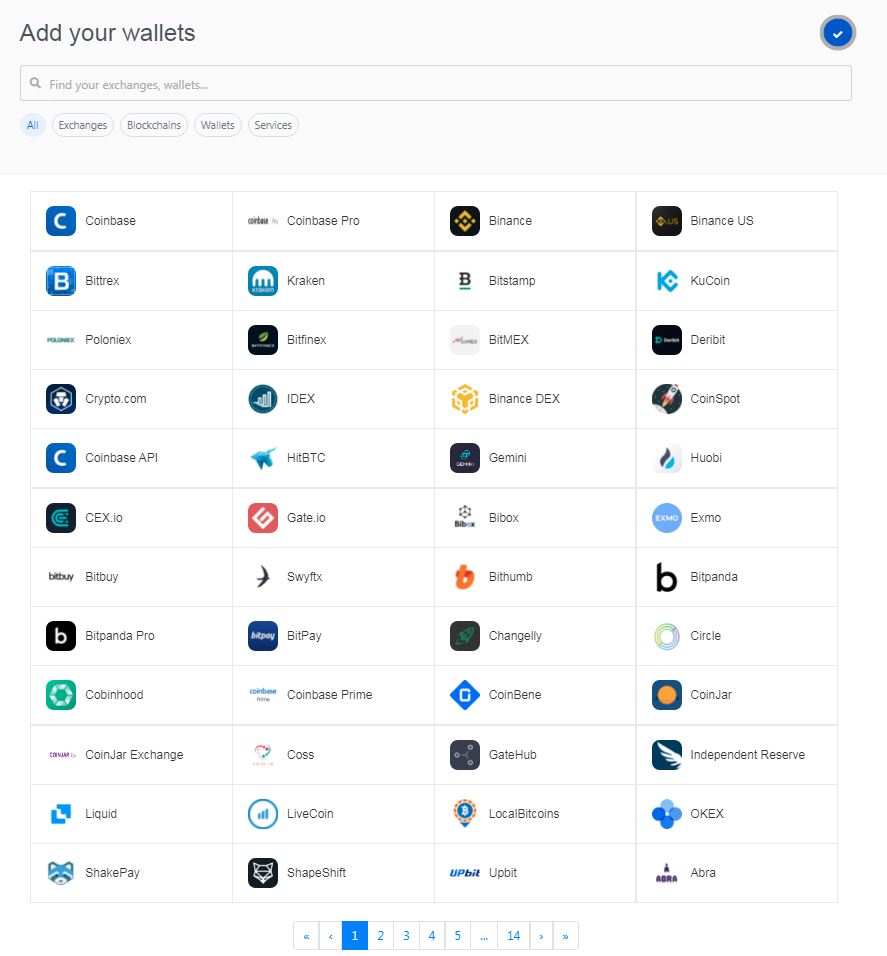

Next you need to add your wallets. There are pages and pages of exchanges and wallet options. Some of the main ones people use are Binance, Coinbase, Bittrex and CoinSpot.

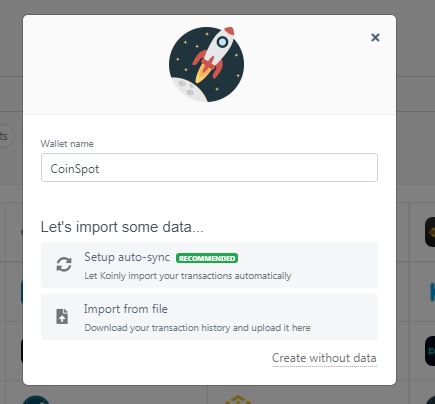

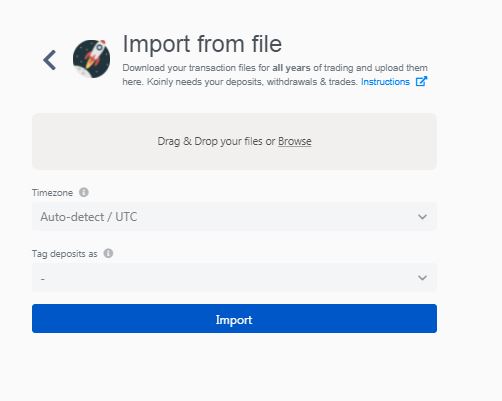

Once you have clicked on your wallet a box will pop up and you can name your wallet. Now it’s time to import the wallet’s data.

For this example we have selected CoinSpot as it is the most commonly used crypto platform for Australians. With CoinSpot you can either upload using the CoinSpot API or using an exported .csv file.

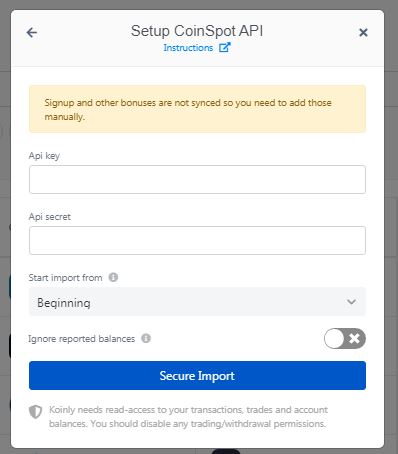

To import via API you will need your API key and your API secret. You can get these by navigating to the drop down arrow in your CoinSpot account then clicking on API which is near the Withdraw AUD tab.

If you decide to upload your .csv data instead you can find the data by navigating to the “order history” tab and then clicking on both the “sends/receives CSV” and the “buys/sells CSV” buttons. Then just download these files and upload them in the upload section as seen above on your Koinly account. Don’t forget if you use CSV files you need to make sure you import your deposits/withdrawals and trades for ALL years and not just the current financial year.

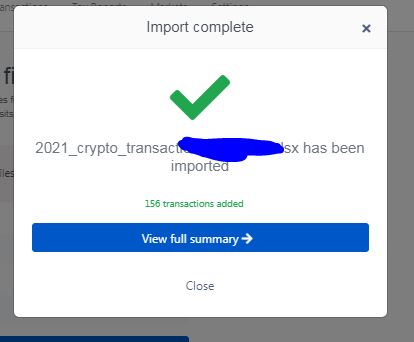

Once you have uploaded your files you will see the below “import complete” box.

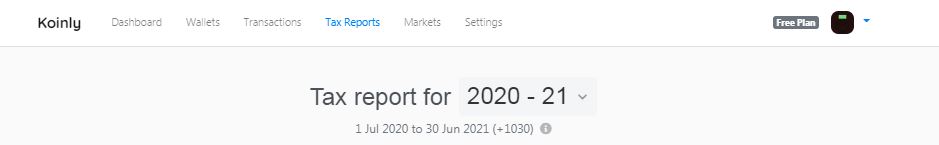

You can then navigate in Koinly over to the “tax reports” tab at the top of the screen. Use the drop down to select the financial year you are looking to view reports for.

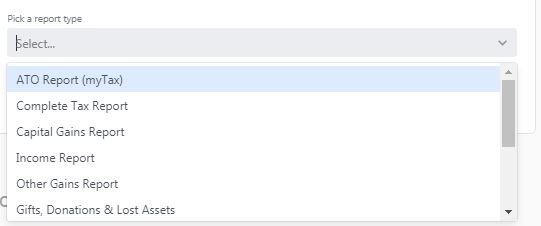

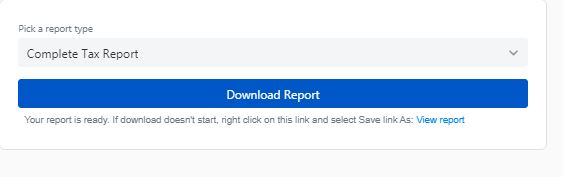

Then you just scroll down to “pick a report type”. The main reports you will use will be either ATO Report (myTax) or the “Complete Tax Report”. This will depend if your crypto trading is on income account or on capital account.

Income account means you will require an ABN and you fill our your trading activity in the business schedule. Capital account means you will fill out the CGT section and you will be entitled to the 12 month CGT discount on holdings that you have held longer than 12 months prior to sale.

To determine which classification you fall under we recommend you read this tax guide by CoinSpot. https://www.coinspot.com.au/cryptotax

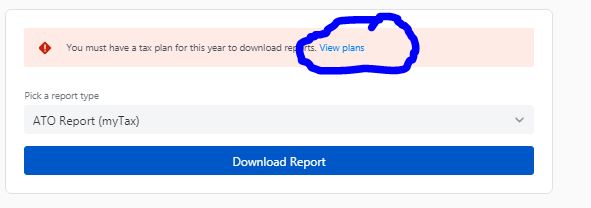

Once you have selected the report you require then when you click “download report” you will see “view plans” in blue. Click that and select the option you require.

Choose your plan and apply promo code if you have one. Then click buy now.

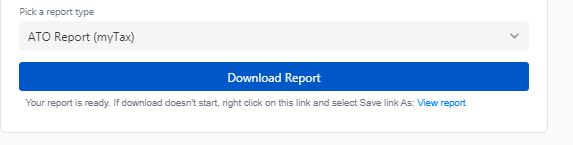

Then click on download report and your report will generate.

If you are in doubt as to which report we recommend the “complete tax report” as that has all the information required for either income account or capital account.

We hope this guide has been easy to follow and will save you a fortune. If it has helped you in any way please share it around for us.